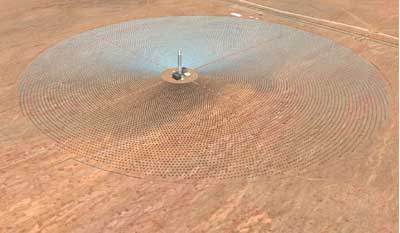

photo: Ausra

The week kicked off with French nuclear energy giant Areva’s acquisition of Silicon Valley solar company Ausra. As I wrote Monday in the Los Angeles Times:

French nuclear energy giant Areva has jumped into the U.S. renewable energy market with the acquisition of Ausra, a Silicon Valley solar power plant startup backed by high-profile venture capitalists.

Terms of the deal were not disclosed, but in an interview on Monday, Areva executive Anil Srivastava said that the price the company paid for Ausra was in line with the $418 million that rival Siemens spent last year to acquire Solel, an Israel solar power plant builder.That would be a decent payday for Ausra’s investors, which include marquee Silicon Valley venture capital firms Kleiner Perkins Caufield & Byers and Khosla Ventures.

“The current shareholders are very well-reputed venture capitalists and I can assure you they negotiated very well,” said Srivastava, the chief executive of Areva’s renewable energy division.

You read the rest of the story here.

And the week is ending with Thursday’s announcement of another Silicon Valley-European deal. This time, as I write in The New York Times, California’s SunPower is acquiring a European solar developer:

SunPower, a leading Silicon Valley solar company, said on Thursday that it has agreed to acquire SunRay Renewable Energy, a European photovoltaic power plant builder, in a $277 million deal.

The acquisition follows Monday’s purchase of Ausra, another Silicon Valley solar technology company, by Areva, the French nuclear energy giant in a deal that an Areva executive valued at around $400 million.

SunPower has previously supplied solar panels to SunRay, which has a pipeline of projects in Europe and Israel that totals 1,200 megawatts. SunRay, which is headquartered in Malta, is owned by its management and Denham Capital.

You can read the rest of that story here.