In Wednesday’s New York Times, I write about a growing movement to repurpose farmland and toxic waste sites for big renewable energy projects:

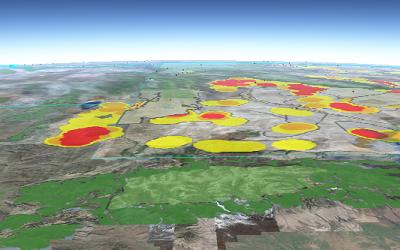

LEMOORE, Calif. — Thousands of acres of farmland here in the San Joaquin Valley have been removed from agricultural production, largely because the once fertile land is contaminated by salt buildup from years of irrigation.

But large swaths of those dry fields could have a valuable new use in their future — making electricity.

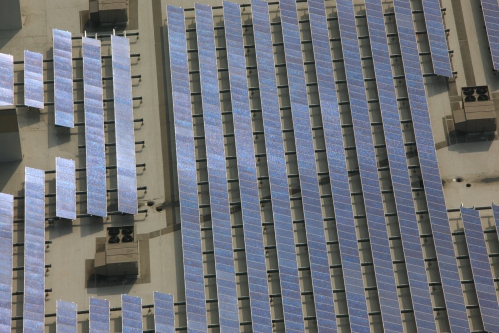

Farmers and officials at Westlands Water District, a public agency that supplies water to farms in the valley, have agreed to provide land for what would be one of the world’s largest solar energy complexes, to be built on 30,000 acres.

At peak output, the proposed Westlands Solar Park would generate as much electricity as several big nuclear power plants.

Unlike some renewable energy projects blocked by objections that they would despoil the landscape, this one has the support of environmentalists.

The San Joaquin initiative is in the vanguard of a new approach to locating renewable energy projects: putting them on polluted or previously used land. The Westlands project has won the backing of groups that have opposed building big solar projects in the Mojave Desert and have fought Westlands for decades over the district’s water use. Landowners and regulators are on board, too.

“It’s about as perfect a place as you’re going to find in the state of California for a solar project like this,” said Carl Zichella, who until late July was the Sierra Club’s Western renewable programs director. “There’s virtually zero wildlife impact here because the land has been farmed continuously for such a long time and you have proximity to transmission, infrastructure and markets.”

Recycling contaminated or otherwise disturbed land into green energy projects could help avoid disputes when developers seek to build sprawling arrays of solar collectors and wind turbines in pristine areas, where they can affect wildlife and water supplies.

The United States Environmental Protection Agency and the National Renewable Energy Laboratory, for instance, are evaluating a dozen landfills and toxic waste sites for wind farms or solar power plants. In Arizona, the Bureau of Land Management has begun a program to repurpose landfills and abandoned mines for renewable energy.

In Southern California, the Los Angeles Department of Water and Power has proposed building a 5,000-megawatt solar array complex, part of which would cover portions of the dry bed of Owens Lake, which was drained when the city began diverting water from the Owens Valley in 1913. Having already spent more than $500 million to control the intense dust storms that sweep off the lake, the agency hopes solar panels can hold down the dust while generating clean electricity for the utility. A small pilot project will help determine if solar panels can withstand high winds and dust.

“Nothing about this is simple, but it’s worth doing,” Austin Beutner, the department’s interim general manager, said of the pilot program.

All of the projects are in early stages of development, and many obstacles remain. But the support they’ve garnered from landowners, regulators and environmentalists has attracted the interest of big solar developers such as SunPower and First Solar as well as utilities under pressure to meet aggressive renewable energy mandates.

Those targets have become harder to reach as the sunniest undeveloped land is put off limits.

Last December, Senator Dianne Feinstein, Democrat of California, introduced legislation to protect nearly a million acres of the Mojave Desert from renewable energy development.

But the senator’s bill also includes tax incentives for developers who build renewable energy projects on disturbed lands.

For Westlands farmers, the promise of the solar project is not clean electricity, but the additional water allocations they will get if some land is no longer used for farming.

“Westlands’ water supply has been chronically short over the past 18 years, so one of the things we’ve tried to do to balance supply and demand is to take land out of production,” said Thomas W. Birmingham, general manager of the water district, which acquired 100,000 acres and removed the land from most agricultural production. “The conversion of district-owned lands into areas that can generate electricity will help to reduce the cost of providing water to our farmers.”

I wrote this story for Reuters, where it first appeared on November 30, 2010.

I wrote this story for Reuters, where it first appeared on November 30, 2010.