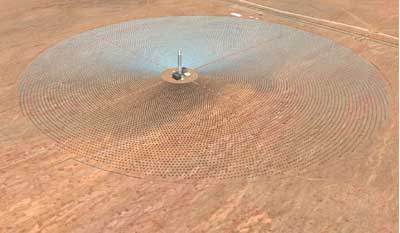

Image: SolarReserve

Ok, I’m exaggerating a bit in the headline above but we’re getting closer to solar farms that will provide baseload power, operating at night and under cloudy conditions. As I write on Tuesday in The New York Times:

The holy grail of renewable energy is a solar power plant that continues producing electricity after the sun goes down.

A Santa Monica, Calif., company called SolarReserve has taken a step toward making that a reality, filing an application with California regulators to build a 150-megawatt solar farm that will store seven hours’ worth of the sun’s energy in the form of molten salt.

Heat from the salt can be released when it’s cloudy or at night to create steam that drives an electricity-generating turbine.

The Rice Solar Energy Project, to be built in the Sonoran Desert east of Palm Springs, will “generate steady and uninterrupted power during hours of peak electricity demand,” according to SolarReserve’s license application.

So-called dispatchable solar farms would in theory allow utilities to avoid spending billions of dollars building fossil fuel power plants that are fired up only a few times a year when electricity demand spikes, like on a hot day.

SolarReserve is literally run by rocket scientists, many of whom formerly worked at Rocketdyne, a subsidiary of the technology giant United Technologies. Rocketdyne developed the solar salt technology, which was proven viable at the 10-megawatt Solar Two demonstration project near Barstow, Calif., in the 1990s.

You can read the rest of the story here.