Over the weekend The New York Times’ Matthew L. Wald had a sobering story on the not-inconsiderable challenges facing efforts to expand and upgrade the United States’ power grid to tap renewable energy from wind farms and solar power plants. Among them: Opposition to new high-voltage power lines from landowners and environmentalists, a Byzantine permitting process and fights over who pays the costs of transmission projects that span state lines.

Here in California, the ongoing controversy over the Sunrise Powerlink project is a case study in just how difficult it will be to build the infrastructure to transmit electricity from dozens of solar power plants planned for the Mojave Desert. Among the big companies looking to cash in on the solar land rush: Goldman Sachs (GS), Chevron (CVX) and FPL (FPL)

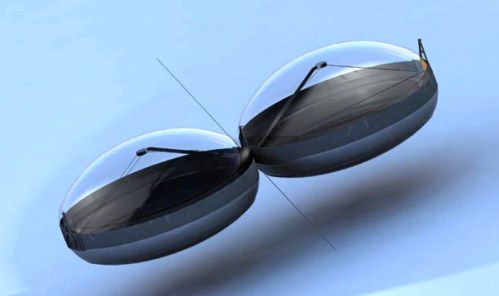

Utility San Diego Gas & Electric first proposed the $1.3 billion, 150-mile Sunrise Powerlink in 2005 to connect the coastal metropolis with remote solar power stations and wind farms in eastern San Diego County and the Imperial Valley. For instance, SDG&E’s contract to buy up to 900 megawatts of solar electricity from massive solar farms to be built by Stirling Energy Systems is dependent on the construction of the Sunrise Powerlink. Like California’s other big investor-owned utilities – PG&E (PCG) and Southern California Edison (EIX) – SDG&E, a unit of energy giant Sempra (SRE), is racing the clock to meet a state mandate to obtain 20% of its electricity from renewable sources by 2010 and 33% by 2020.

But Sunrise sparked opposition from the get-go as the utility proposed routing part of the transmission project through a pristine wilderness area of the Anza-Borrego Desert State Park. The prospect of 150-foot-tall transmission towers marching through critical habitat for desert tortoises and other protected wildlife galvanized environmentalists well-versed in the arcane arts of regulatory warfare.

Opponents also painted the project as a Trojan horse to bring in cheap coal-fired power from Mexico. (Wald makes a similar point in his Times‘ piece – the same high-voltage lines designed to transmit green electricity from wind farms can also be used to send cheap carbon-intensive coal-fired electricity across the country.) That argument subsequently lost currency when regulators, citing California’s landmark global warming law, barred utilities from signing long-term contracts for out-of-state coal power.

After more than three years of hearings and procedural skirmishes culminating in an 11,000-page environmental impact report, a PUC administrative law judge last October issued a 265-page decision all but killing the project on environmental grounds. Whether SDG&E thought that green energy and climate change concerns would trump worries over wildlife and wilderness, it was clear that trying to build an industrial project through a state park was a costly mistake.

Then in December, after California Governor Arnold Schwarzenegger signed an executive order to streamline and prioritize the licensing of renewable energy projects, the utilities commission’s board revived Sunrise Powerlink, approving a different route for the transmission lines that avoids Anza-Borrego.

But the fight is far from over. With the cost of the project now approaching $2 billion, late last month the Center for Biological Diversity, a Tucson, Ariz.-based environmental group, filed a suit in the California Supreme Court challenging the utilties commission’s approval of Sunrise Powerlink.

Safe to say, the battle will drag on for some time to come, giving new meaning to the term “stranded assets” for some would-be Big Solar developers.