graphic: The Pew Charitable Trusts

Clean energy jobs grew 9.1% over the past decade and now number 770,000 as the green tech economy makes inroads in every U.S. state and outstrips conventional job creation, according to a new study released Wednesday by The Pew Charitable Trusts.

Non-green energy jobs, in contrast, grew by 3.7% between 1998 and 2007. The traditional fossil fuel industry employed 1.27 million workers in 2007.

Pew worked with California research firm Collaborative Economics to conduct an actual count of 68,200 businesses engaged in its definition of the clean energy economy — activity that “generates jobs, businesses and investments while expanding clean energy production, increasing energy efficiency, reducing greenhouse gas emissions, waste and pollution, and conserving water and other natural resources.”

Clean energy economy jobs were divided into five sectors: clean energy, energy efficiency, environmentally friendly production, conservation and pollution mitigation, and training and support.

“Americans are struggling to get a sense of the nation’s economic future,” Lori Grange, interim deputy director of the Pew Center on the States, said on a conference call Wednesday morning. “The nation’s clean energy economy is poised for explosive growth.”

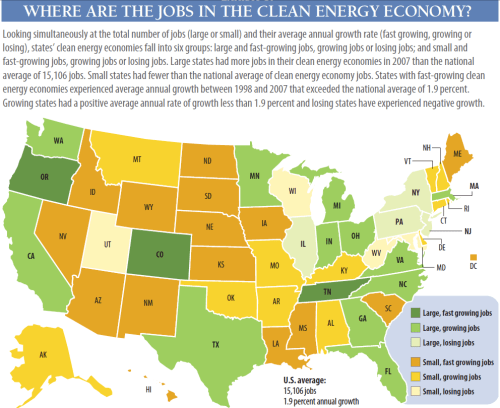

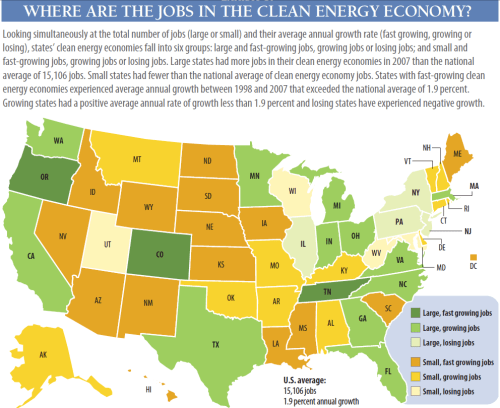

“It just isn’t California,” she added. “Every state has a piece of the clean energy economy.”

Nevertheless, California remains a clean-energy unto itself and boasted 125,390 jobs generated by 10,209 green businesses in 2007. The Golden State, not surprisingly, attracted $6.6 billion in venture capital funding between 2006 and 2008, six times the amount captured by the runner-up, Massachusetts. Startups focused on clean energy and energy efficiency scored 80% of venture capital investments. California also led in clean energy patents, with 1,401 granted between 1998 and 2007 compared to New York’s 909.

California, however, is getting a run for its money from Oregon, Colorado and other states. Oregon had one of the fastest rates of clean energy job creation and those jobs accounted for the highest percentage of overall employment compared to other states — between .82% and 1.02%.

And Texas, for instance, is the world’s sixth-largest producer of wind energy, Pew researchers said.

The report’s patent numbers offer one indication of where the clean energy economy is headed. Between 1999 and 2008, batteries accounted for 46.6% of the patents while fuel cells took 25.6%. Solar had 8.7% of all clean energy patents and wind had 5%. However, the growth rate in battery patents fell 33% between 1999 and 2008 while fuel cell patents jumped 96% and hybrid system patents grew 147%. Solar patents fell 15% as wind patents grew 155%.

The average annual salaries for clean energy jobs ranged from $21,000 to $111,000, according to the Pew report.

State policies requiring renewable energy production and energy efficiency measures have played a significant role in driving green energy job growth, the Pew authors said. A map showing regions with the biggest green job growth correlate with a map of states with the strongest renewable energy policies.