January 11, 2010 by Todd Woody

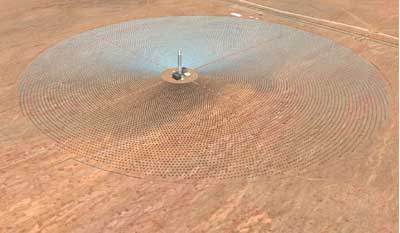

photo: eSolar

In my new Green State column on Grist, I take a look at the implications of California startup eSolar’s 2,000 megawatt solar thermal deal with China:

Forget Red China. It’s Green China these days—at least when it comes to making big renewable deals.

Friday night, a Chinese developer and eSolar of Pasadena, Calif., signed an agreement to build solar thermal power plants in the Mongolian desert over the next decade. These plants would generate a total of 2,000 megawatts of electricity. It’s the largest solar thermal project in the world and follows another two-gigawatt deal China struck in October with Arizona’s First Solar for a massive photovoltaic power complex. Altogether, the eSolar and First Solar projects would produce, at peak output, the amount of electricity generated by about four large nuclear power plants, lighting up millions of Chinese homes.

Is China the new California, the engine powering the green tech revolution?

Yes and no. When it comes to technological and entrepreneurial innovation, Beijing lags Silicon Valley (and Austin, Boston, and Los Angeles)—for now. But as a market, China is likely to drive demand for renewable energy, giving companies like eSolar the opportunity to scale up their technology and drive down costs.

[We’ll pause here to state the obvious: China’s investment in renewable energy and other green technologies is miniscule compared to the resources devoted to its continued building of coal-fired power plants and efforts to secure dirty oil shale supplies in Canada and elsewhere.]

“All the learning from this partnership will help us in the United States,” Bill Gross, eSolar’s founder and chairman, told me. “I think as soon as the economy improves in the rest of the world and banks start lending, there will be a lot of competition in the U.S. and Europe. But, until then, China has the money and the demand.”

In a one-party state, a government official saying, “Make it so,” can remove obstacles to any given project and allocate resources for its development. Construction of the first eSolar project, a 92-megawatt power plant, in a 66-square-mile energy park in northern China, is set to begin this year

“They’re moving very fast, much faster than the state and U.S. governments are moving,” says Gross, who is licensing eSolar’s technology to a Chinese firm, Penglai Electric, which will manage the construction of the power plants. Another Chinese company will open and operate the projects

You can read the rest of the column here.

Posted in alternative energy, eSolar, renewable energy, solar energy, solar power plants | Tagged China, eSolar, Grist, solar energy, solar power plants, solar thermal | Leave a Comment »

January 11, 2010 by Todd Woody

photo: Think

In The New York Times on Monday, I write about a new McKinsey report that looks at the potential for electric cars in three of the world’s “megacities” — New York, Paris and Shanghai:

New Yorkers, start your electric cars.

A report from the consulting firm McKinsey, scheduled to be issued Monday, found that about a fifth of New York City residents are “early adopters” likely to purchase an electric car. Such vehicles could account for 16 percent of automobile sales by 2015, with 70,000 electric and plug-in hybrid electric cars on city streets.

Even so, the city would only see a net two percent reduction in carbon emissions from the replacement of gasoline-powered cars by electric vehicles, or EVs, according to a summary of the report provided to The Times.

“Achieving a visible carbon effect from EV penetration will require a higher penetration of the fleet and further improvements in local power generation, with a higher share of renewables and less carbon-intensive technology in the future,” the report said.

Those findings were part of a study gauging the appeal of electric cars in three large cities – New York, Paris and Shanghai. The report’s release comes as electric vehicles take center stage at the opening of the Detroit auto show Monday.

You can read the rest of the story here.

Posted in electric cars, environment, green cars, green policy | Tagged electric cars, McKinsey, New York City | Leave a Comment »

January 11, 2010 by Todd Woody

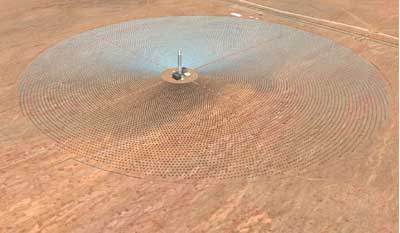

photo: eSolar

In The New York Times on Monday, I follow up on my story in Saturday’s Los Angeles Times on China’s move into solar thermal power with a 2,000 megawatt deal with eSolar of California:

China’s plans to build 2,000 megawatts of solar thermal power using technology from a California company, eSolar, will also include the construction of biomass power plants to generate electricity when the sun sets.

The solar and biomass plants will share turbines and other infrastructure, reducing the projects’ cost and allowing around-the-clock electricity production, according to Bill Gross, eSolar’s chairman.

“That supercharges the economics of solar,” said Mr. Gross in a telephone interview, noting that the addition of biomass generation will allow power plants to operate at 90 percent of capacity.

Under terms of the deal announced Saturday in Beijing, eSolar will license its “power tower” technology to Penglai Electric, which will manage the construction of the power plants over the next decade.

Another Chinese company, China Shaanxi Yulin Huayang New Energy Co., will own and operate the first projects to be built in the 66-square-mile Yulin Energy Park in northern China.

A local shrub grown in the surrounding region to fight desertification, called the sand willow, will supply fuel for the biomass power plants, according to Penglai Electric.

“It’s an economical use of a resource that’s already in place,” said Nathaniel Bullard, a solar analyst with Bloomberg New Energy Finance, a research and consulting firm. “That’s a very savvy move, rather than attach an energy storage system to the solar project.”

You can read the rest of the story here.

Posted in alternative energy, environment, eSolar, renewable energy, solar energy, solar power plants | Tagged biomass solar hybrid, China, eSolar, Penglai Electric | Leave a Comment »

January 10, 2010 by Todd Woody

photo: eSolar

In Saturday’s Los Angeles Times, I write about a ground-breaking solar thermal deal struck by eSolar of Pasadena, Calif., to build two gigawatts of power plants in China over the next decade:

ESolar Inc. of Pasadena signed an agreement Friday to build a series of solar thermal power plants in China with a total capacity of 2,000 megawatts, in one of the largest renewable energy deals of its kind.

Coming four months after an Arizona company, First Solar, secured a contract to build an equally large photovoltaic power plant in China, the ESolar deal signals China’s emergence as a major market for renewable energy.

“They’re moving very fast, much faster than the state and U.S. governments are moving,” said Bill Gross, ESolar’s chairman and the founder of Idealab.

Under the agreement, ESolar will provide China Shandong Penglai Electric Power Equipment Manufacturing Co. the technology and expertise to build solar “power tower” plants over the next decade. Those solar farms would generate a total of 2,000 megawatts of electricity; at peak output that would be equivalent to a large nuclear power plant. The terms of the agreement were not disclosed.

The initial project, which includes a 92-megawatt solar power plant to be built this year, will be located in the 66-square-mile Yulin Energy Park in the Mongolian desert in northern China. The region has become a hot spot for renewable energy, with the 2,000-megawatt First Solar project planned 60 miles to the north.

You can read the rest of the story here.

Posted in alternative energy, energy, enviro startups, environment, eSolar, solar energy, solar power plants | Tagged Bill Gross, China, eSolar, Penglai Electric, solar energy, solar power plants, solar thermal | Leave a Comment »

January 6, 2010 by Todd Woody

image: SolFocus

In The New York Times on Wednesday, I write about the year-end green tech investing numbers for 2009:

In a flurry of dealmaking bolstered by government subsidies for renewable energy, venture capitalists invested $5.6 billion in green technology companies worldwide in 2009, according to a preliminary report released Wednesday by the Cleantech Group and Deloitte.

That represents a 33 percent drop over the $8.5 billion invested in 2008 — a reflection, the report said, of the global economic downturn. But the overall amount of venture capital fared much worse, retreating to 2003 levels, according to the report, whereas clean technology investments were on track to match 2007 levels.

“In 2009, clean-tech went from a niche category to become the dominant category in venture capital investing,” said Dallas Kachan, managing director of the Cleantech Group, a San Francisco market research and consulting firm. “Clean-tech continued to outpace software and biotech.”

The report’s preliminary survey showed that there were 557 deals in the clean technology space in 2009, compared to 567 deals in 2008 and 488 in 2007.

Solar companies secured $1.2 billion in 2009 — 21 percent of the total and the largest share of venture funding. The biggest deal of the year also went to a solar company, Silicon Valley’s Solyndra, which raised $198 million at the same time it secured a $535 million federal loan guarantee to build a solar module factory.

You can read the rest of the story here.

Posted in alternative energy, electric cars, energy, energy efficiency, enviro startups, environment, green financing, solar energy | Tagged clean tech investing, green technology, venture capital | Leave a Comment »

January 5, 2010 by Todd Woody

photo: Think

In The New York Times on Tuesday, I write about Norwegian electric carmaker Think’s announcement that it will open its first U.S. assembly plant in Indiana:

Think, the Norwegian electric carmaker, said on Tuesday that it will open its first American assembly plant in Elkhart, Ind.

The Think City, a battery-powered, two-seat hatchback, is set to begin rolling off the Indiana assembly line in early 2011, ramping up to a potential annual production of 20,000 cars by 2013. The factory is expected to eventually employ more than 400 workers.

About 1,500 of the plastic-bodied cars are already on the street in Europe, and Think will begin selling the City in the United States later this year. The car will be imported from a Finland assembly plant until the Indiana factory opens in a former recreational vehicle factory.

Think’s investment in the Indiana facility depends in part on securing a United States Department of Energy loan guarantee to finance the project, according to Richard Canny, Think’s chief executive.

“Our plan is based around the D.O.E. loan,” Mr. Canny said in a telephone interview on Tuesday. “If that didn’t happen we would be looking at a slower and shallower investment plan.”

Indiana was one of several states vying for the Think assembly plant. Tax incentives offered by Indiana and Elkhart’s proximity to automotive suppliers in neighboring Michigan helped clinch the deal, according Mr. Canny.

You can read the rest of the story here.

Posted in electric cars, environment, green cars, Think | Tagged assembly plant, electric cars, Indiana, Think | Leave a Comment »

December 29, 2009 by Todd Woody

Image: U.S. EPA

In my new Green State column on Grist, I write about how the U.S. Environmental Protection Agency has made its annual year-end enforcement report relevant to the average citizen by creating a Google map mashup that let’s you quickly pinpoint any environmental violations in your neighborhood:

‘Tis the season for the annual year-in-review column, beloved by writers and editors desperate to fill pages and screens of blank space during these slow news weeks.

I’m going to forgo that annual holiday journalism tradition—sort of. While perusing various year-end and year-ahead trend story pitches that had popped into my in-box since Thanksgiving, I came across one from the United States Environmental Protection Agency that caught my attention.

The EPA was releasing its annual enforcement stats for 2009. Usually that’s a big yawn, given that for most of the past decade prosecuting polluters was not high on the must-do list of the former administration. But in 2009 not only was there a much more enforcement-minded EPA administrator in Washington (in the person of Lisa Jackson), the agency for the first time created a Google map mashup of its enforcement actions for the year.

The map lets you zoom in on your city, county, or state and see the civil and criminal cases filed by the EPA for violations of its clean air and water laws and other environmental statutes. Click on the air, water, land, and criminal buttons and colored markers start to populate the map showing you the location of various violations. When you click on a marker a link to detailed information about the case pops up. You can also review any past violations.

You can read the rest of the column here.

Posted in environment, green policy | Tagged environmental enforcement, Google maps, U.S. Environmental Protection Agency | Leave a Comment »

December 28, 2009 by Todd Woody

photo: SolarReserve

In The New York Times on Saturday, I write about utilities NV Energy and PG&E signing power purchase agreements to buy electricity from SolarReserve’s solar farms, which store the sun’s energy in molten salt to generate power at night:

Solar farms that would serve two Western utilities are planning to use technology that will generate electricity after the sun goes down, a move that could be a potential game-changer for the industry.

The two farms being planned by SolarReserve of Santa Monica, Calif., would store the sun’s energy in molten salt, releasing the heat at night when it could be used to drive a turbine and generate electricity. Two utilities, NV Energy in Nevada and Pacific Gas and Electric, Northern California’s biggest utility, would buy the power.

The sun’s intermittent nature has made large-scale solar farms most useful as so-called peaker plants that supply electricity when demand spikes, typically in the late afternoon on hot days. But the ability of SolarReserve to store the sun’s energy for use at night would be a step forward in technology.

“The energy storage characteristics were a key factor in our selection of the Tonopah solar energy project,” NV Energy’s chief executive, Michael Yackira, said in a statement. The utility will be able to draw electricity from the solar farm more or less on demand, which makes it easier to balance the load on the power grid.

NV Energy would buy power from the 100-megawatt Crescent Dunes Solar Energy Project being planned on federal land near Tonopah, Nev., about 215 miles northwest of Las Vegas.

“We’re expecting to put in 12 hours of storage, which allows us to move power within the day to meet peak requirements as well as to operate at full load,” SolarReserve’s chief executive, Kevin Smith, said of the Tonopah plant.

You can read the rest of the story here.

Posted in alternative energy, environment, PG&E, renewable energy, solar energy, solar power plants, SolarReserve | Tagged NV Energy, PG&E, solar energy, solar power plants, SolarReserve | Leave a Comment »

December 22, 2009 by Todd Woody

image: Tessera Solar

In a follow-up to my New York Times story Tuesday on Senator Dianne Feinstein’s bill to ban renewable energy production in parts of California’s Mojave Desert, I take a look at some of the incentives in the legislation that could speed green energy projects:

In Tuesday’s Times, I write about Senator Dianne Feinstein’s bill to create two Mojave Desert monuments in California that would ban renewable energy projects on lands that are both coveted for solar farms and valued for their sweeping vistas and populations of rare wildlife.

The mere prospect of the legislation has derailed several massive solar power plants planned by Goldman Sachs and other developers. But Mrs. Feinstein, a California Democrat, has included provisions in the bill that could, if enacted, accelerate renewable energy development and ease tensions over endangered species that are slowing other solar projects outside the monument area.

In a big concession to renewable-energy advocates, Mrs. Feinstein would allow transmission lines to be built through existing utility rights-of-way in the monument to transmit renewable energy from other desert areas to coastal metropolises. That will not likely sit well with some of the senator’s environmental allies. (Nor will a provision that permanently designates areas of the desert for off-road vehicle use.)

The legislation also features a pilot program to assemble huge tracts of land -– at least 200,000 acres — to be used as endangered species habitat to make up for areas lost to renewable energy production.

You can read the rest of the story here.

Posted in alternative energy, BrightSource Energy, endangered species, energy, environment, green policy, green tech, solar energy, solar power plants | Tagged BrightSource Energy, desert tortoise, Goldman Sachs, Mojave Desert, Senator Dianne Feinstein, solar energy, solar power plants, Tessera Solar, wildlife | Leave a Comment »

December 22, 2009 by Todd Woody

In Tuesday’s New York Times, I write about California Senator Dianne Feinstein’s move to ban renewable energy production in two proposed national monuments in the Mojave Desert:

AMBOY, Calif. — Senator Dianne Feinstein introduced legislation in Congress on Monday to protect a million acres of the Mojave Desert in California by scuttling some 13 big solar plants and wind farms planned for the region.

But before the bill to create two new Mojave national monuments has even had its first hearing, the California Democrat has largely achieved her aim. Regardless of the legislation’s fate, her opposition means that few if any power plants are likely to be built in the monument area, a complication in California’s effort to achieve its aggressive goals for renewable energy.

Developers of the projects have already postponed several proposals or abandoned them entirely. The California agency charged with planning a renewable energy transmission grid has rerouted proposed power lines to avoid the monument.

“The very existence of the monument proposal has certainly chilled development within its boundaries,” said Karen Douglas, chairwoman of the California Energy Commission.

For Mrs. Feinstein, creation of the Mojave national monuments would make good on a promise by the government a decade ago to protect desert land donated by an environmental group that had acquired the property from the Catellus Development Corporation.

“The Catellus lands were purchased with nearly $45 million in private funds and $18 million in federal funds and donated to the federal government for the purpose of conservation, and that commitment must be upheld. Period,” Mrs. Feinstein said in a statement.

The federal government made a competing commitment in 2005, though, when President George W. Bush ordered that renewable energy production be accelerated on public lands, including the Catellus holdings. The Obama administration is trying to balance conservation demands with its goal of radically increasing solar and wind generation by identifying areas suitable for large-scale projects across the West.

Mrs. Feinstein heads the Senate subcommittee that oversees the budget of the Interior Department, giving her substantial clout over that agency, which manages the government’s landholdings. Her intervention in the Mojave means it will be more difficult for California utilities to achieve a goal, set by the state, of obtaining a third of their electricity from renewable sources by 2020; projects in the monument area could have supplied a substantial portion of that power.

“This is arguably the best solar land in the world, and Senator Feinstein shouldn’t be allowed to take this land off the table without a proper and scientific environmental review,” said Robert F. Kennedy Jr., the environmentalist and a partner with a venture capital firm that invested in a solar developer called BrightSource Energy. In September, BrightSource canceled a large project in the monument area.

You can read the rest of the story here.

Posted in alternative energy, BrightSource Energy, climate change, endangered species, enviro startups, environment, global warming, green policy, green startups, PG&E, renewable energy, solar energy, solar power plants, Tessera Solar | Tagged BrightSource Energy, desert tortoise, Goldman Sachs, Mojave Desert, Senator Dianne Feinstein, solar energy, solar power plants, Tessera Solar, wildlife | Leave a Comment »

« Newer Posts - Older Posts »