With Congress back in session, renewable energy proponents are girding for a battle over legislation that could make or break the nascent solar power industry.

With Congress back in session, renewable energy proponents are girding for a battle over legislation that could make or break the nascent solar power industry.

At stake in the energy bill now before Congress is the survival of a 30 percent investment tax credit that makes large-scale solar power plants a viable option for utilities under pressure to cut greenhouse gas emissions by obtaining more of their electricity from renewable sources. On the home front, a similar tax credit for residential solar installations is up for grabs as Congress tries to reconcile House and Senate versions of the energy legislation.

“There are at least eight or nine well-funded companies that are actually making great progress in developing large-scale solar,” says Joshua Bar-Lev, vice president for regulatory affairs for Oakland, Calif.,-based solar power plant developer BrightSource Energy. “I don’t know if any of them are going to be able to finance projects and get the permits they need without these tax credits.”

The solar companies and their allies in the utility industry and on Wall Street had been pressing for an eight-year extension of the investment tax credit. They also want to abolish a prohibition on utilities from taking advantage of the incentive if they invest directly in solar power plants. But since word hit the street that Congressional leaders were considering stripping out the incentives to speed passage of the complex legislation — catchall bills that will affect the fate of nearly every energy-related industry, from Big Oil to biofuels — solar proponents have been converging on the Capitol in an 11th-hour lobbying frenzy.

“Things are very uncertain at the moment,” says Chris O’Brien, an executive at solar panel maker Sharp who serves as chairman of the Solar Energy Industries Association, a trade group. “In recent years, we’ve seen a very sharp increase in corporate investment, project investment and financing for solar technology companies and solar projects. There’s great concern that the U.S. market continue to grow.”

Like other renewable energy sectors, solar has lived and died at the hands of tax incentives. In the 1980s a California tax break encouraged the construction of the state’s first utility-scale power plants by Luz International, founded by BrightSource’s chairman. When the incentives evaporated with the return of cheap energy that decade, the company’s business disappeared (though those Mojave Desert solar power stations continue to operate).

Global warming fears, renewable energy mandates imposed on utilities and a flood of venture capital has revived Big Solar over the past two years. The industry argues that longer term tax incentives must be put in place to ensure solar power plant builders have enough time to break into the electricity market and achieve economies of scale that will drive down the cost of green energy. This time around, the solar entrepreneurs have attracted the support of utilities like PG&E (PCG) and Edison International (EIX) as well as Wall Street titans like Goldman Sachs (GS) and Morgan Stanley (MS), both of which have invested in renewable energy companies. (Morgan Stanley, for instance, is backing BrightSource.)

“We’ve gone to Congress and talked to members about the need for multi-year commitments so we have certainty,” Rick Carter, PG&E’s director of federal government relations, told Green Wombat. “What we’ve seen over past couple years is stop-and-go with tax credits. If you have multi-year leads to build facilities, that doesn’t work.”

Take California, for example. Negotiations between a solar energy company and a utility over a power purchase agreement can last more than a year and it can take another three or four years to to obtain regulatory approval for a solar power plant, secure the site and then get the facility built and operating. PG&E, Southern California Edison and San Diego Gas & Electric (SRE) all have signed long-term power purchase agreements for solar power plants that will be financed and built over the next several years.

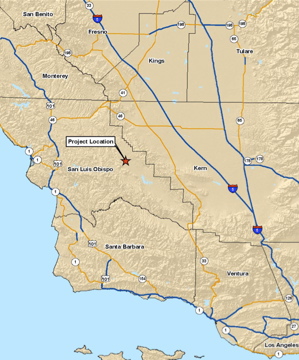

Given that the prime solar sites and potential economic payoff for Big Solar is in the sun-drenched West, companies like BrightSource have been targeting Congress members from western states. “We want both representatives and senators to see the benefit of this: price certainty, jobs, clean energy,” says Bar-Lev.

While the situation changes daily, action on the energy legislation is expected sometime in the next two weeks.