PASADENA, Calif. — If you wanted a snapshot of the emerging alliance between utilities and automakers, the car park of the Langham hotel here was the place to be Tuesday morning. There was the CEO of one of the largest utilities in the United States putting the pedal to the metal of the battery-powered Think City with Think Global CEO Jan-Olaf Willums riding shotgun.

PASADENA, Calif. — If you wanted a snapshot of the emerging alliance between utilities and automakers, the car park of the Langham hotel here was the place to be Tuesday morning. There was the CEO of one of the largest utilities in the United States putting the pedal to the metal of the battery-powered Think City with Think Global CEO Jan-Olaf Willums riding shotgun.

“I liked it a lot,” PG&E (PCG) Chairman and CEO Peter Darbee told Green Wombat after a few spins around the hotel in the electric coupe. “The acceleration was fast, it handled well and it has a European feel.”

We had just finished a Fortune Brainstorm Green session on electric cars (along General Motors’ (GM) executive Beth Lowery), where Darbee declared, “We want to replace the oil industry” as the fuel supplier to the automakers. Fuel in this case is electricity, though unlike Big Oil, regulated utilities such as PG&E and Southern California Edison (EIX) will not make windfall profits no matter how many electrons they push into Chevy Volts.

The topic at hand was the potential for vehicle-to-grid, or V2G, if electric cars go mass market. The big idea: electric cars are essentially mobile generators and rolling energy storage devices. When hundreds of thousands of them are plugged in, they can not only download electricity but return power to the grid from their batteries, allowing utilities to meet peak demand without firing up expensive fossil fuel power plants that often sit idle until everyone cranks up their air conditioners.

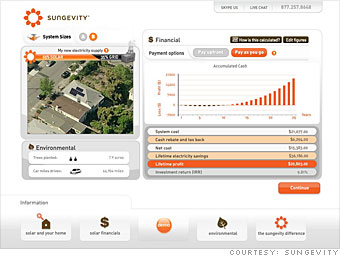

PG&E is working with Google (GOOG) to develop technology to allow a smart power grid to detect where an electric car is plugged in so the owner can be charged or credited with consuming electricity or returning it to the grid. The smart grid would also be able to detect power demand spikes and then tap the appropriate number of car batteries to smooth out the electricity supply.

Utilities like PG&E are eager to forge alliances with electric carmakers for other reasons. In California, electric cars could be charged at night when greenhouse gas-free power sources like wind farms tend to produce the most electricity but when demand otherwise falls off. Utilities are also interested in buying used electric car batteries (which retain 80 percent of their capacity even after they’re no longer good for transportation) to store renewable energy that can be released when electricity demand spikes.

Lowery, GM’s vice president for environment, energy and safety policy, said such interest from utilities is prompting the automaker to think how electric cars could spawn new markets. “We’re definitely looking at different business models for batteries,” she said.

On Monday, Think Global and venture capital powerhouses Kleiner Perkins Caufield & Byers and Rockport Capital Partners announced the formation of Think North America as a joint venture between the Norwegian company and the VCs that will bring the Think City to California next year.

Rockport managing general partner and acting Think North America president Wilber James was at the panel and suggested Think supply some cars to PG&E. As the session ended, Darbee, James and Willums headed to the parking lot where Willums showed off the car’s Internet-enabled interactive features, including a video screen with a button already labeled “vehicle-to-grid.”