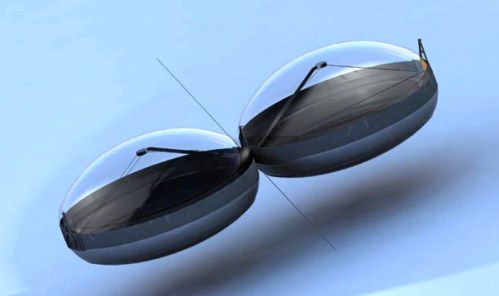

Image: Cool Earth

LIVERMORE, Calif. – It sounds like something out of one of those do-it-your-self magazines: Stitch together two buck’s worth of thin-film plastic – the stuff potato chip bags are made of – stick in a photovoltaic cell, inflate with air and, voilà, you’ve got yourself a “solar balloon” that will generate a kilowatt of electricity. String together 10,000 balloons and you’ve got a solar power plant that can power a town.

California startup Cool Earth Solar believes this high-low tech approach is what will make its solar power plants competitive with fossil fuels. Green Wombat visited Cool Earth’s Livermore headquarters recently for a Fortune Magazine story and got a look at the technology. “We wanted to do solar in a very different way,” says Cool Earth CEO Rob Lamkin.

Different it is. We’re standing in Cool Earth’s back shop in front of an eight-foot-high solar balloon. Two pounds of plastic are pumped with a third of a pound of air per square inch to make the balloon taut. The curved top two-thirds of the balloon is transparent and the bottom is made of the silvery reflective plastic you’d find lining a bag of junk food. A steel strut inside will hold a tiny but highly efficient solar cell, which is the most high-tech component of the balloon.

Here’s the ingenious part of the technology, developed by scientists at Caltech: Instead of using expensive optics to concentrate sunlight on the solar cell, Cool Earth manipulates the air pressure inside the balloon to change the shape of the mirrored surface so that it focuses the maximum amount of sunlight on the solar cell, boosting electricity generation 300 to 400 times.

By replacing expensive materials like steel with cheap-as-chips plastic and air, Cool Earth aims to dramatically lower the price of solar electricity. “We strongly believe it’s all about cost,” says Lamkin, “not how clever the technology is or if it is 1% more efficient.” For instance, the amount of aluminum in a can of Coke would provide enough reflective material for 750 balloons, he notes.

The company, founded in 2007, has raised $21 million so far. It plans to build solar power stations in the 10-megawatt to 30-megawatt range. Two to six balloons will be suspended on wood poles and anchored with cables about 10 feet off the ground. That means the earth won’t have to be graded, reducing the environmental impact of Cool Earth’s power plants – a growing issue given that most solar thermal power stations will be built in the desert, home to a plethora of protected wildlife. The relatively compact size of Cool Earth’s power stations also means they can be located close to existing transmission lines.

A prototype power plant is being built in a field across the street from Cool Earth’s offices and Lamkin says a 1.5 megawatt plant will be constructed early next year in the Central Valley town of Tracy. The electricity probably will be sold to utility PG&E (PCG) under a state renewable energy program.

Unlike big solar thermal plants, photovoltaic power stations do not need to obtain a license from the California Energy Commission, which can be an expensive two-year ordeal. Lamkin estimates that a Cool Earth power plant can be up and running in six months, which should appeal to utilities like PG&E, Southern California Edison (EIX) and San Diego Gas & Electric (SRE), which are under the gun to meet state mandates to obtain 20% of their electricity from renewable sources by 2010.

Now Cool Earth just needs to make the technology work in the field. It has yet to produce electricity from its balloons, as the solar cells are still being produced. Also unknown is how the balloons will operate in real-world conditions. Lamkin says they can withstand 125-mile-an-hour winds. They have a lifespan of just five years, but Cool Earth expects to replace the balloons every year, given their low cost.

“Our major structural element is air, which so far is free,” Lamkin says. “And the sun isn’t taxed either.”

Yet.