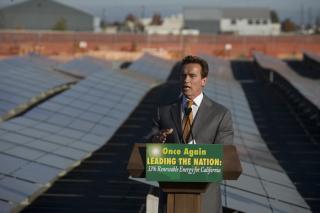

photo: Ausra

The promise and peril of large-scale renewable energy was on display Thursday as California’s first solar power plant of the 21st century went online near Bakersfield. Under blue skies, Governor Arnold Schwarzenegger and other politicians heralded the five-megawatt Ausra solar station as the vanguard of a new era of alternative energy that would combat the effects of climate change while building a green economy.

Then the CEO of one of the nation’s largest utilities stepped up to the podium and delivered a reality check. “As we all know the capital markets are in disarray,” said PG&E chief Peter Darbee, whose utility has a contract to buy 177 megawatts of electricity from Ausra. “They’re down 40%. The capital markets are going to distinguish between high-risk projects and low-risk projects and the high-risk projects are not going to get financed in the future.”

But he added, “PG&E stands ready to take on the challenge of financing renewables.”

The utility may just have to.

At the solar industry’s big annual conference in San Diego last week, renewable energy executives were euphoric over Congress’ 11th-hour passage this month of an eight-year investment tax credit that would allow big solar power plants to get up and running, eventually allowing for economies of scale crucial to driving down the price of green electricity. Then a dark clouded drifted over the sun-splashed proceedings in the form of three somber-suited men bearing ominous PowerPoint presentations.

The message from Wall Street: The credit crunch will wallop big solar plant projects that need billions of dollars in financing to get built.

Here’s why. It gets a bit arcane but bear with the wombat. The renewable energy legislation passed as part of the financial bailout package allows solar companies to take a 30% tax credit on the cost of building a power plant. Now most of these companies are startups and have no way to monetize, as they say on the Street and in Silicon Valley, those tax credits as they’re not profitable. Instead, a solar company must essentially trade the tax credits to a firm that can use them in exchange for cash to finance construction.

So investors form something called a tax equity partnership, in which they agree to finance, say, a solar power plant in exchange for the tax credits generated by the project. The problem, according Tim Howell, managing director of renewable energy for GE (GE) Energy Financial Services, is that investors’ appetite for tax equity partnerships has taken a nose dive just as the market will be flooded with solar tax credits from a growing number of projects currently being licensed. For instance, he said, 1,000 megawatts of solar projects would generate $1.5 billion in tax credits.

That means there has to be enough investment dollars – or “capacity” in Wall Street lingo – available to buy those tax credits from the solar power companies. “Competition for tax capacity, which is a scarce resource in tough financial times, is a problem we have to solve,” Howell told a packed ballroom in San Diego.

John Eber, managing director of JPMorgan Capital (JPM), flashed a PowerPoint that showed the total value of the tax equity market at $15 billion last year with 40% going to renewable energy projects, mainly wind. Now that investment banks-which put together the partnerships and sometimes invested their own capital-are all but an extinct species on Wall Street, only an estimated $875 million will be available for all solar projects in 2008. In contrast, he noted, just the solar power plant projects already announced would need between $6 billion and $8.5 billion in tax equity funding.

“Tax equity is becoming increasingly hard to raise for renewable energy projects,” said Keith Martin, a project finance attorney at the Washington firm Chadbourne & Parke. “Several large institutional investors who put money into renewable energy deals in the last three years have dropped out of the market.”

That, they said, means untried technologies from startups will face higher hurdles to attract investors.

In conversations Green Wombat has had with solar power plant executives over the past couple of weeks, they acknowledge that financing will be much harder to come by but they’re hardly ready to throw in the towel.

“There’s probably a gigawatt of press releases and 200 megawatt of plants that acutally will go live in 2010,” says John Woolard, CEO of Oakland-based BrightSource Energy, which has a contract with PG&E to deliver up to 900 megawatts of electricity.

His point: Despite gigawatts of signed utility deals, only a few power plants will actually be built in the next couple of years when financing is expected to be the toughest to obtain. “In 2011, it’s reasonable that 500 to 600 megawatts could happen,” he says. “Those aren’t big numbers for the tax equity market, but if you believe everything that’s been announced is going to be built, then it is a big market.”

California utilities, however, are counting on that big market to meet a state mandate to obtain 20% of their electricity from renewable sources by 2010 with a 33% target for 2020. PG&E (PCG), for instance, has signed 20-year power purchase agreements for more than 2.5 gigawatts of solar electricity.

When Congress extended the solar investment tax credit it also lifted a ban on utilities claiming the tax subsidy. Hence PG&E chief Peter Darbee’s statement Thursday that his utility would be willing to make sure its projects get funded by using the company’s considerable capital clout.

“We certainly could look at potentially funding or investing in renewable projects,” PG&E senior vice president Greg Pruett told Green Wombat Thursday. While he said PG&E has no specific projects in mind, it might consider financing construction of solar power plants through a tax equity partnership or a direct investment.

“Say we have a solar thermal company and they have a proven technology and they have done a demonstration plant, but because of the markets they can’t get financing,” says Pruett. “We might consider investing so they can build the plant and get it online.”

He says it’s less likely that PG&E would get into the solar construction business itself.

While it’s anyone’s guess how the markets will shake out by the time solar companies start making the rounds in New York, it’s clear that a shakeup in the nascent solar power plant business is in the offing.

Read Full Post »