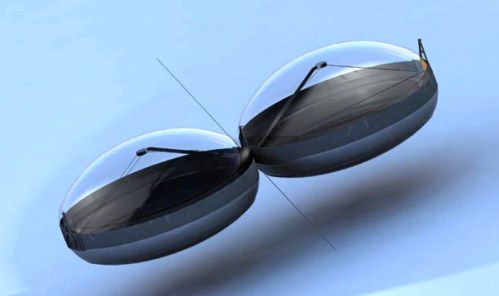

photo: Think

Think Global, the innovative Norwegian electric car company, has temporarily halted production of its City urban runabout and laid off half its workforce as it considers a sale to survive the credit crisis, Think CEO Richard Canny told Green Wombat Tuesday.

“Think is in a situation where we can’t grow anymore,” Canny said from Think’s Oslo headquarters, where the management team was still working at midnight. “We have started an emergency shutdown to protect our capital and our brand. We’ll need a new and stronger partner, whether that is a 25% owner or a majority owner or someone who buys the company.”

The Norwegian government said on Tuesday that it would not make an equity investment in the automaker but is considering Think’s request to guarantee up to $29 million in short-term loans. “Even a small participation from the Norwegian government will give investors confidence,” Canny said, noting that the company needs to raise $40 million to continue manufacturing its electric car. “The financial crisis has hit at a very critical stage as we’re ramping up production and when external financing is hard to bring into the company and internal funding is limited.”

He said a rescue package might include aid from from the Norwegian government and an infusion of cash from new investors or strategic partners. “We’re putting a hand out. People who would like to work with us should pick up the phone.”

Ford (F) acquired the startup in 1999 and sold it a few years later. Norwegian solar entrepreneur Jan-Olaf Willums and other investors rescued Think from bankruptcy in 2006, aiming to upend a century-old automotive paradigm by changing the way cars are made, sold and driven to create a sustainable auto industry.

As Green Wombat wrote in a 2007 feature story on Think, “Taking a cue from Dell, the company will sell cars online, built to order. It will forgo showrooms and seed the market through car-sharing services like Zipcar. Every car will be Internet-and Wi-Fi-enabled, becoming, according to Willums, a rolling computer that can communicate wirelessly with its driver, other Think owners, and the power grid. In other words, it’s Web 2.0 on wheels. ‘We want to sell mobility,’ Willums says. ‘We don’t want to sell a thing called the Think.’

The company sells the car but leases the battery so buyers don’t have to fork over cash upfront for an electric vehicle’s single most expensive component – an idea subsequently adopted embraced by everyone from Shai Agassi’s Better Place electric car infrastructure company to General Motors (GM).

The failure of the new Think would be a blow at a time when the auto industry desperately needs to reinvent itself. While Think is a niche player and faces formidible competition as Toyota (TM) and other big automakers go electric, it has pioneered the idea of a new automotive infrastructure that includes tech companies and utilities like PG&E (PCG).

Whether Think can survive the global financial crisis remains to be seen, but Willums, who stepped aside as CEO recently but remains on the board, is a prodigious networker with deep contacts in Silicon Valley and elsewhere. In little more than a year he raised around $100 million from an A-list of U.S. and European investors that includes General Electric (GE), Keiner Perkins Caulfield & Byers and Rockport Capital Partners – the latter two marquee venture capital firms formed a joint venture with Think to sell the City in North America. Canny said the U.S. expansion plans are now on hold.

The question now is whether Think’s investors, absent a government bailout, will step up to save the company just as it has started to gain a foothold in the market. In a presentation made Monday, Canny, a Ford veteran, said eight to 10 two-seater City cars a day had been rolling off the company’s assembly line outside Oslo. Think has a blacklog of 550 orders and 150 cars will be delivered by January. The company was set to begin selling a 2+2 version of the City in mid-2009. (Think had planned to begin selling its next model, a five-seat crossover car called the Think Ox, in 2011.)

“There are limited possibilities of funding working capital through bank credits without extra guarantees in today’s financial market,” Canny said, noting that the company hopes to resume production in the first quarter of 2009. “Think’s automotive suppliers are severely hit by the overall industry crisis, leading to tougher terms of parts delivery to Think.”

Green Wombat will throw out one potential savior of Think: Google (GOOG). Many aspects of Think’s innovative business model were born at a brainstorming session that the search giant hosted in 2006 for Willums at the Googleplex in Mountain View, Calif. Given that Google.org, the company’s philanthropic arm, has poured tens of millions of dollars in green energy companies and electric car research, an investment in Think would be another way to drive progress toward its goal of a carbon-free economy.