In The New York Times on Thursday, I write about how California regulators are helping revive a once-thriving solar hot water market:

California regulators on Thursday approved a $350 million program to subsidize the installation of solar water heaters to reduce greenhouse gas emissions.

The program will allocate $250 million for the replacement of hot water heaters fueled by natural gas and $100.8 million for those powered by electricity.

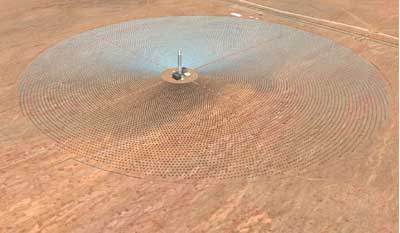

Solar hot water systems typically consist of a storage tank and a rooftop array that collects heat from the sun to warm the water.

Customers of California’s three big investor-owned utilities will receive rebates of up to $1,500, or about 30 percent of the cost of replacing a residential natural-gas hot water heater with a solar system. Owners of multi-family commercial buildings are eligible for up to $500,000 in incentives.

The California Public Utilities Commission reserved 60 percent of the funds to install solar hot water systems on those buildings, with the balance going to single-family homes.

Homeowners with electric hot water heaters can receive up to $1,010 to install a solar hot water system and owners of commercial buildings will get up to $250,000. Only about 10 percent of hot water systems in California are electric, according to the utilities commission.

The program’s goal is to replace 585 therms of natural gas -– the equivalent of installing 200,000 solar hot water systems — and 150 megawatts of electricity by 2017. Incentives decrease over the eight-year life of the program.

“Today’s decision will increase consumer confidence and understanding of solar water heating technology and its benefits,” Michael R. Peevey, president of the utilities commission, said in a statement.

You can read the story of the story here.