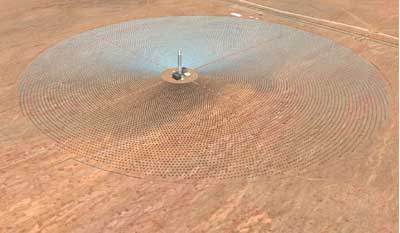

photo: eSolar

In my new Green State column on Grist, I take a look at the implications of California startup eSolar’s 2,000 megawatt solar thermal deal with China:

Forget Red China. It’s Green China these days—at least when it comes to making big renewable deals.

Friday night, a Chinese developer and eSolar of Pasadena, Calif., signed an agreement to build solar thermal power plants in the Mongolian desert over the next decade. These plants would generate a total of 2,000 megawatts of electricity. It’s the largest solar thermal project in the world and follows another two-gigawatt deal China struck in October with Arizona’s First Solar for a massive photovoltaic power complex. Altogether, the eSolar and First Solar projects would produce, at peak output, the amount of electricity generated by about four large nuclear power plants, lighting up millions of Chinese homes.

Is China the new California, the engine powering the green tech revolution?

Yes and no. When it comes to technological and entrepreneurial innovation, Beijing lags Silicon Valley (and Austin, Boston, and Los Angeles)—for now. But as a market, China is likely to drive demand for renewable energy, giving companies like eSolar the opportunity to scale up their technology and drive down costs.

[We’ll pause here to state the obvious: China’s investment in renewable energy and other green technologies is miniscule compared to the resources devoted to its continued building of coal-fired power plants and efforts to secure dirty oil shale supplies in Canada and elsewhere.]

“All the learning from this partnership will help us in the United States,” Bill Gross, eSolar’s founder and chairman, told me. “I think as soon as the economy improves in the rest of the world and banks start lending, there will be a lot of competition in the U.S. and Europe. But, until then, China has the money and the demand.”

In a one-party state, a government official saying, “Make it so,” can remove obstacles to any given project and allocate resources for its development. Construction of the first eSolar project, a 92-megawatt power plant, in a 66-square-mile energy park in northern China, is set to begin this year

“They’re moving very fast, much faster than the state and U.S. governments are moving,” says Gross, who is licensing eSolar’s technology to a Chinese firm, Penglai Electric, which will manage the construction of the power plants. Another Chinese company will open and operate the projects

You can read the rest of the column here.