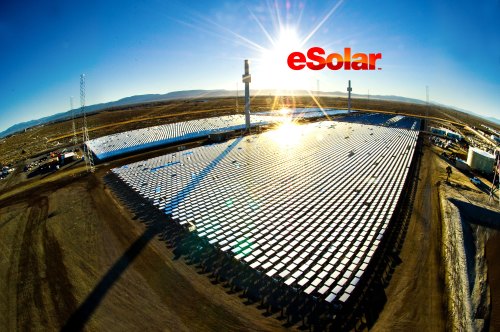

photo: eSolar

SAN FRANCISCO — “It’s all about the software,” says eSolar CEO Bill Gross.

The tech entrepreneur and founder of startup incubator Idealab is explaining how eSolar’s solar power plants can produce carbon-free electricity cheaper than planet-warming natural gas. At the Cleantech Forum in San Francisco, Gross flashes a photo of eSolar’s demonstration solar farm outside the Southern California town of Lancaster, where 24,000 mirrors called heliostats surround two 150-foot towers. The heliostats concentrate sunlight on a tower containing water-filled boilers and the resulting heat creates steam that drives an electricity-generating turbine. Rivals like BrightSource Energy use similar “power tower” technology but according to Gross, eSolar’s mirror-controlling software and modular plant design will allow it to produce cheaper solar electricity.

For instance, Gross says competitors use large, slightly curved mirrors to focus sunlight. That require big and expensive steel frames to hold the glass in place. eSolar’s solution: make small flat mirrors the size of an LCD television screen that clamp on to a 5 x 12-inch frame and then use software and Big Iron computing to position the mirrors to create a parabola out of the entire heliostat field.

“We use Moore’s law rather than more steel,” quipped Gross, referring to Intel co-founder Gordon Moore’s maxim that computing power doubles every two years.

The heliostats roll off an assembly line in China with the wiring and sun-tracking motors built in. “The only tool required to install mirrors in the field is a hand wrench,” Gross says. “There’s no welding in field, you just install the mirrors on the base. We’ve taken all the labor in the field and moved it to an automated factory.”

The heliostats also do not have to be precisely placed in the solar field, which saves time. “The rows can be wavy as the software will correct for it,” Gross notes. “We don’t need to do extensive surveys to design the field; we just need to leave enough space between mirrors.”

The bottom line: The five-megawatt Palmdale project was built in less than six months. “We think we can finish plants before other people start,” Gross told Green Wombat.

Gross says eSolar has also signed a 92-megawatt deal with a New Mexico utility, which he declined to identify until the agreement is announced. He said his Pasadena, Calif.-based company will also soon unveil a contract to build 500 megawatt’s worth of solar farms in Asia. So far, eSolar has spent $30 million acquiring land – mainly privately owned agricultural property – for solar power plants, according to Gross. He told Cleantech Forum participants that eSolar expects internal rates of return for its partners of between 11% and 14% for U.S. power plants and returns of 20% to 30% for overseas projects.

Also saving time and money are the power towers, which are made from two sections of a windmill tower. At 150 feet they’re half the size of competitors’ towers – again, less steel is needed. The lower height and the software systems that allow more mirrors to be crammed into smaller spaces means that eSolar’s power plants can be placed closer to urban areas where transmission lines are available.

Also unique is the boiler that sits atop the tower. Gross gave Green Wombat a close-up look the proprietary technology. About the size of a cargo shipping container, the “cavity receiver” has openings on either side. The heliostats focus sunlight into the interior of the boiler, which is lined with water-filled pipes.

“The benefit is that the light comes in and even if some light is reflected it can have multiple bounces and still hit the pipes,” Gross says. “We can get all the light inside the cavity all because of the software that controls the mirrors.”

Whether Google (GOOG)-backed eSolar’s plants produce electricity at the low rates Gross is claiming won’t be known until they start coming online. But utilities are betting that this solar software works. Southern California Edision (EIX) last year signed a 20-year-contract with eSolar for 245 megawatts of electricity while coal-dependent NRG Energy (NRG) this week agreed to invest $10 million in eSolar in exchange for the right to develop up to 500 megawatts using the company’s technology. (Southern California Edison is betting even bigger on BrightSource Energy’s power tower technology – two weeks ago the utility signed a 1,300 megawatt power purchase agreement with the Oakland startup – also backed by Google – the world’s largest solar deal to date.)

Oakland-based BrightSource will build seven solar power plants for Southern California Edison (

Oakland-based BrightSource will build seven solar power plants for Southern California Edison (