In the world’s single-largest investment in solar technology, the oil-rich emirate of Abu Dhabi announced Wednesday it will spend $2 billion to jumpstart a home-grown photovoltaics industry. The cash will fund what is undoubtedly the planet’s best-financed startup, Masdar PV, which will build manufacturing facilities in Germany and Abu Dhabi to produce thin-film solar modules that can be used in rooftop solar systems or solar power plants.

Masdar PV is the latest project of the Masdar Initiative, Abu Dhabi’s $15 billion renewable energy venture designed to transform the emirate into a green technology powerhouse. Masdar is best known for its plans to build Masdar City, a “zero-carbon, zero-waste” urban center.

Thin-film solar cells are essentially “printed” on glass or flexible metals, allowing them to be integrated into building materials like roofs and walls. Though thin-film solar is less efficient at converting light into electricity, it uses a fraction of the expensive silicon needed by conventional bulky solar modules and can be produced much more cheaply – provided economies of scale are achieved.

Thus Masdar PV’s big solar bet. “You have to be working at scale to drive costs out of the system,” Steve Geiger, Masdar’s director of special projects, told Fortune in a phone call from Abu Dhabi. “We have to do it at scale and we have to do it in volume in multiple markets.”

One of those markets is the United States, where Masdar PV could give established players like First Solar (FSLR) and startups such as Nanosolar, Heliovolts and Global Solar some formidable competition.

The gamble Masdar PV is taking is that it’s investing billions in an older but proven thin-film technology that may well be left in the dust by more exotic, cheaper and efficient technologies under development by a host of startups.

Masdar PV aims to have a gigawatt of annual production capacity in place by 2014. To get there, Geiger says the company has hired a management team that includes former top executives from First Solar and other thin-film industry veterans.

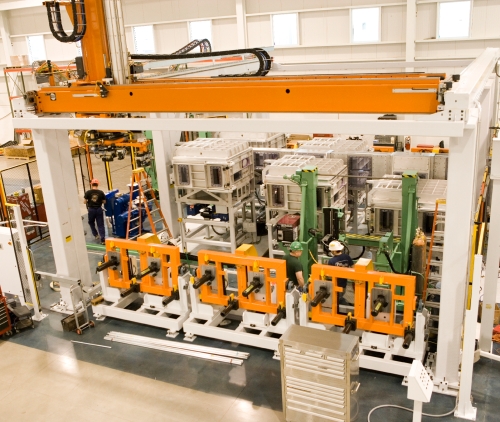

A leading solar technology company that Geiger declined to identify will provide the manufacturing equipment for Masdar PV’s factories. Judging from his description, the likely supplier is Applied Materials (AMAT), the world’s biggest computer-chip equipment maker that has a burgeoning business building the machines that make thin-film solar cells of the type that Masdar PV will produce.

“We usually partner with large companies that have managerial skills, technology and market access, but we were very fortune that we picked up a top management team and thought it was strong enough to do as a 100% Abu Dhabi Masdar company,” says Geiger, who will oversee Masdar’s thin-film solar venture.

Masdar PV’s first plant is scheduled to go online in Germany toward the end of 2009 with the second to begin production in Abu Dhabi by mid-2010. “Very clearly we need to look at expansion beyond those two physical facilities,” Geiger says. “We really have to look at America and the Asian markets as well.

Thin-film is just one of three solar strategies that Masdar is pursuing by funneling petrodollars into green energy startups. In March, Masdar unveiled Torresol Energy, a joint venture with a Spanish company that will build large-scale solar thermal power plants to supply electricity to utilities. Masdar has also made investments in other solar thermal companies as well as thin-film startups pursuing different technologies. Finally, Masdar wants to produce polysilicon, the basic material of conventional solar cells.

As Masdar chief Sultan Ahmed Al Jaber recently told Green Wombat, “We want to cover the whole value chain – from research to labs to manufacturing to the deployment of technologies.”

Geiger uses an analogy for Masdar’s green energy ambitions that may be more familiar to petroleum-dependent Americans – and should serve as a wake-up call to get serious about carbon-free energy. “The model might be the vertically integrated oil industry,” he says. “It clearly makes sense to have a consolidated power provider.”

Read Full Post »

The looming expiration of a crucial renewable energy investment tax credit doesn’t seem to have spooked investors. Silicon Valley thin-film solar startup Nanosolar said Wednesday that it has secured another $300 million in funding and is jumping into the Big Solar game as well.

The looming expiration of a crucial renewable energy investment tax credit doesn’t seem to have spooked investors. Silicon Valley thin-film solar startup Nanosolar said Wednesday that it has secured another $300 million in funding and is jumping into the Big Solar game as well.

“Our processes really require high productivity, so what makes it competitive here in the Midwest is that we have a great labor force that is eager to work and well-trained already,” ECD chief executive Mark Morelli told Green Wombat on Monday.

“Our processes really require high productivity, so what makes it competitive here in the Midwest is that we have a great labor force that is eager to work and well-trained already,” ECD chief executive Mark Morelli told Green Wombat on Monday.