SAN FRANCISCO – Google and General Electric said Wednesday that they will collaborate on developing geothermal power as well as technology to enable plug-in vehicles to return electricity to the grid.

SAN FRANCISCO – Google and General Electric said Wednesday that they will collaborate on developing geothermal power as well as technology to enable plug-in vehicles to return electricity to the grid.

During Google’s (GOOG) annual Zeitgeist conference at its Silicon Valley headquarters, Google CEO Eric Schmidt and GE (GE) chief Jeff Immelt said the two giants also would team up to push for policy changes in Washington to develop smart electricity grids to allow the widespread deployment of renewable energy.

“There’s two fundamental things that have to be done, and which we’re working with Google on,” said Immelt before an audience that included former Vice President Al Gore. “One, there has to be more capacity. The second thing is there has to be a smart grid to allow it to operate more effectively. That’s primarily software. We make the hardware.”

Schmidt quizzed Immelt about the impact of the Wall Street meltdown on green energy. “Will the craziness of last week screw some of this stuff up?” asked Schmidt. “Are we going to get set back for years because of all the shenanigans in the financial industry?”

“People should be concerned but not panicked,” replied Immelt. “The federal government is doing the right thing.”

Gore was not so sanguine, noting that Congress has failed repeatedly to extend crucial investment tax credits for renewable energy. “While Congress is voting on oil drilling and leasing oil shale – which is a move that would be game over for the climate crisis – they’re preparing to filibuster over renewable energy tax credits,” he said.

Google and GE are among scores of Fortune 500 companies that have lobbied Congress to extend the investment tax credit and the production tax credit, which is particularly important to the wind industry. ”

“I’m a lifelong Republican and I believe in free markets but over time we worship false idols,” says Immelt. “Sometimes we think the free market is whatever the price of oil is today. In the end, clean energy is both a technology and a public policy.”

He noted that because the production tax credit allowed the wind industry to scale up, wind-generated electricity now costs about six-to-seven cents a kilowatt hour, down from 15 cents 15 years ago.

“We bought Enron’s wind business for a few million dollars and now it’s worth $7 to 8 billion,” Immelt said. “I’ve made some bad decisions but that wasn’t one of them.”

Google in August invested nearly $11 million in geothermal companies developing so-called enhanced geothermal systems technology to allow the earth’s heat to be tapped nearly anywhere and turned into electricity. On Wednesday, Google and GE said they will work on technology to transform geothermal into a large-scale source of green electricity.

In a statement, the two companies said they will also “explore enabling technologies including software, controls and services that help utilities enhance grid stability and integrate plug-in vehicles and renewable energy into the grid.”

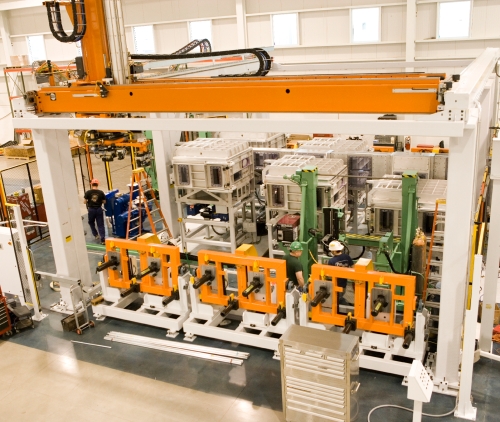

“Our processes really require high productivity, so what makes it competitive here in the Midwest is that we have a great labor force that is eager to work and well-trained already,” ECD chief executive Mark Morelli told Green Wombat on Monday.

“Our processes really require high productivity, so what makes it competitive here in the Midwest is that we have a great labor force that is eager to work and well-trained already,” ECD chief executive Mark Morelli told Green Wombat on Monday.