San Francisco on Friday made a bid to rule the waves, filing an application to build a 30-megawatt wave energy farm off its coast in a move to sink a Seattle company’s claim on a nearby patch of ocean.

The company, Grays Harbor Ocean Energy, has filed applications with the Federal Energy Regulatory Commission, or FERC, for wave projects to be built from New Jersey to Hawaii. Wave energy technology remains in its infancy but there’s been something of a land – or sea – rush to secure rights to the most promising ocean sites to produce clean green electricity.

Last October, Grays Harbor filed for a preliminary permit to test technology for a 100-megawatt wave park to be floated 20 to 25 miles off the San Francisco coast. Grays’ San Francisco Ocean Energy Project “may also generate power from wind turbines” placed on the wave-energy converters, according to the company’s application.

So far the project has generated heated opposition from a coalition of environmental groups, surfers and commercial fishing organizations that have intervened in the case. They argue that the wave farm’s location in federally protected marine sanctuaries near the Farallon Islands could harm endangered whales, turtles and seabirds as well as interfere with surfers, sailors and pose a navigation hazard for oil tankers and other ships.

“Wave energy projects raise many potential environmental concerns, including elevated hydrocarbon concentrations, electromagnetic field effects, interruption of migratory patterns, toxic releases from leaks or spills, impacts to sensitive spawning areas,” wrote the coalition, which includes the Natural Resources Defense Council, in a Jan. 26 letter to FERC.

The next day, the city of San Francisco moved to intervene in the Grays case, saying it would file a competing application. On Friday, the city did so, asking federal regulators to give priority to its Oceanside Wave Energy Project, arguing there’s only room for one wave farm off the San Francisco coast.

The city’s project would be located eight miles offshore, outside the marine sanctuaries. As San Francisco Mayor Gavin Newsom – a Democratic gubernatorial candidate for 2010 – blogged about the municipal wave farm on Friday, the city filed an affidavit from its consultant stating that the Grays project would “impact the nature, quality and direction of the waves” to be used by the Oceanside wave energy plant.

It’s not the first time that San Francisco has tried to scuttle other wave projects. In June 2007, the city unsuccessfully petitioned FERC to deny utility PG&E’s (PCG) application for wave farms hundreds of miles up the coast from San Francisco, contending companies were trying to lock up choice sites.

Despite the rush to file claims, there’s no guarantee that any wave farm will be built. The preliminary permit that San Francisco has applied for would give it the ability to conduct a feasibility study and test wave energy technology with first rights to secure a license build a full-scale wave energy plant.

Although a range of wave technologies are being developed, they generally involve devices that float or are anchored to the seabed that that transform the motion of waves into mechanical energy which drives an electricty generating turbine. The electricity is transmitted through undersea cables to an onshore substation.

In its application, San Francisco said it was considering a number of technologies but anticipates floating between ten and 30 1-megawatt wave energy converters. The city estimates it would spend between $1 million and $3 million on the feasibility study over the next three years.

San Francisco’s green scheme isn’t the only headache for Grays. Like the company’s other proposed wave energy projects, the San Francisco wave farm would sit on the outer continental shelf. The U.S. Department of the Interior’s Minerals Management Service claims jurisdiction over projects on the outer continental shelf and a fight has broken out between the agency and FERC over who gets to issue permits for OCS wave projects. On Jan. 26, the agency filed a challenge to FERC’s right to license eight of Grays wave farms that would also feature wind turbines.

Wrote Interior Department attorneys: “Some believe the preliminary permit application is part of an attempt to stake a claim to certain areas through the FERC process with the objective of siting wind energy projects, over which FERC does not claim jurisdiction, or then, according to press accounts, selling those rights.”

image: Pelamis Wave Power

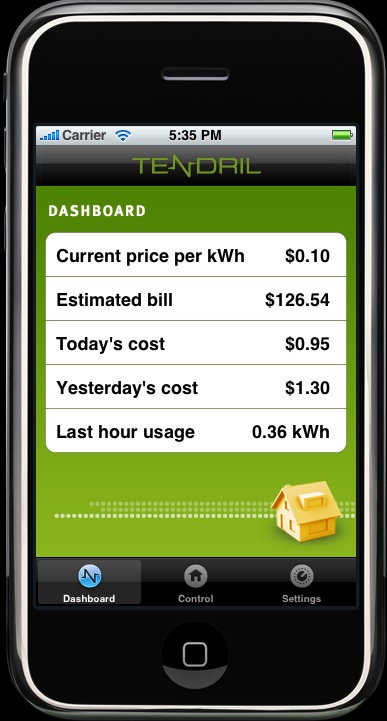

Here’s an iPhone app that really could help save the planet while saving stressed consumers’ money: Boulder, Colo.-based startup Tendril this week unveiled a mobile software program that lets people monitor and control their home’s energy use while on the go.

Here’s an iPhone app that really could help save the planet while saving stressed consumers’ money: Boulder, Colo.-based startup Tendril this week unveiled a mobile software program that lets people monitor and control their home’s energy use while on the go. Another reason Green Wombat will be spending Earth Day in Southern California this year: Former President Bill Clinton will deliver the keynote speech at Fortune Magazine’s

Another reason Green Wombat will be spending Earth Day in Southern California this year: Former President Bill Clinton will deliver the keynote speech at Fortune Magazine’s