This post first appeared on Grist.

Eric Pooley came to San Francisco last Tuesday to talk about his new book, The Climate War, at the offices of the Environmental Defense Fund.

The book, subtitled “True Believers, Power Brokers and the Fight to Save the Earth,” is a riveting tale of the battle to pass climate change legislation in the United States. Pooley, deputy editor of Bloomberg BusinessWeek and the former editor of Fortune magazine, embedded himself with key combatants in the climate war, including Fred Krupp, EDF’s president. (Read a review by Grist’s David Roberts here.)

It is, of course, a book without an ending as efforts to enact a cap on greenhouse gas emissions start to resemble a not-so-funny legislative version of Bill Murray’s “Groundhog Day.”

The timing of Pooley’s Tuesday talk was appropriate, as that day a new front in the climate war opened up on the West Coast when an initiative to suspend California’s landmark global warming law qualified for the Nov. 2 ballot.

The Global Warming Solutions Act of 2006, popularly known by its legislative moniker, AB 32, requires California to reduce greenhouse gas emissions to 1990 levels by 2020. One of the options to do that is to implement a statewide cap-and-trade market to limit emissions by carbon polluters such as oil refiners.

Two Texas oil companies, Valero and Tesoro, are largely funding the anti-AB 32 ballot measure, which the California secretary of state in a bit of cosmic irony has designated Proposition 23 — a reversal of 32, get it?

Prop 23 would put AB 32 on hold until the unemployment rate falls to 5.5 percent for four straight quarters, which is as likely in California as the legislature delivering the state budget on time four years in a row.

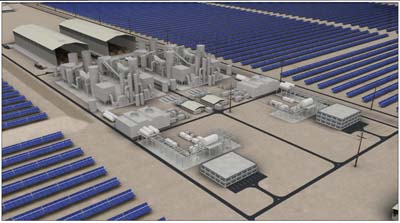

It promises to be an epic battle of the Old Economy vs. the New Economy — Silicon Valley green tech startups, venture capitalists, and big corporations with a stake in the nascent renewable energy economy versus the old industrial giants with the most to lose from the new green order.

“If you look at investment in clean energy, China is now investing $9 billion a month with centralized control of the energy economy the likes of which we can’t equal,” Pooley told EDFers gathered on the 28th floor of a downtown San Francisco tower. “A price on carbon would change the rules of the road and take capital off the sidelines and put it to work building clean energy infrastructure and jobs here in this country. It could happen in California first as so many things have happened in California first.”

“But I really worry about this proposition,” he added. “It’s going to be tough to defeat.”

Pooley noted that the passage of AB 32 in 2006 helped put pressure on the federal government and an administration resolutely opposed to cap and trade. Suspension of AB 32 would take away a big playing card in the climate change poker game.

While the environment may be as Californian as the beach, redwood trees, and plastic surgery, the fight over Prop 23 makes environmentalists nervous, especially in a state with a sky-high unemployment rate.

Pooley asked Derek Walker, director of EDF’s California Climate Initiative, to handicap the electoral odds.

“When I’m asked that question, I would have said a year ago there’s no chance we’ll have a Republican senator from Massachusetts anytime soon,” Walker said. “But I think that all other things being equal, Californians have a very strong ethic for conservation and if there’s enough evidence of the green economy growing in California there’s a compelling case.”

As Pooley noted, “Nobody has done more than California to step up on this issue. There’s never going to be a perfect moment to do this. As if we all can wait for the golden day when all is in order and embrace the future. History does not work that way. Progress does not work that way. We have to rise up to meet the future or we’ll cede it to somebody else.”