Stealth Bay Area solar startup OptiSolar has quietly revealed plans to build the world’s largest photovoltaic solar farm on the central California coast — a $1 billion, 550-megawatt monster that would be nearly 40 times as large as the biggest such power plant operating today.

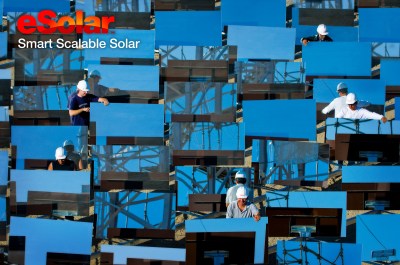

PV solar power plants essentially take solar panels similar to those found on suburban rooftops and put them on the ground. Unlike solar thermal power plants that use mirrors to heat a liquid to produce steam that drives an electricity-generating turbine, photovoltaic power stations generate power directly when the sun strikes the panel’s semiconducting cells. That means there’s virtually no moving parts or need for industrial infrastructure like power blocks, turbines and piping. (A photo of a PV solar farm in Serpa, Portugal, is above.)

But because photovoltaic solar is less efficient at converting sunlight into electricity than solar thermal and requires big swaths of land, it has not been considered economical to build large-scale PV power plants in the United States. (Unlike in Portugal, Spain and other European countries where utilities pay a premium rate for green energy.)

Furthermore, OptiSolar makes thin-film solar cells, which are even less efficient than traditional solar panels. The hoped for advantage of thin-film solar is that the cells can be printed on rolls of metal much more cheaply than bulky conventional solar cells. They also use far less polysilicon –an expensive semiconducting material — than standard solar cells.

Still, hardly any thin-film solar companies in the U.S. have begun mass production, let alone tried to build a huge power plant. OptiSolar intends to both produce solar panels and build and operate solar power plants. It currently has deals to build more than 20 solar farms representing more than 200 megawatts in Canada, which pays higher rates for electricity generated from renewable sources.

“We have propriety technology and a business approach that we’re convinced will let us deploy PV at large scale and be competitive with other forms of renewable energy,” OptiSolar executive vice president Phil Rettger told Green Wombat recently in an interview about the Hayward, Calif.-based company’s plans.

Says Reese Tisdale, a solar energy analyst with Emerging Energy Research: “At this point I see it as an announcement with plenty to prove.” He says the benefits of a large-scale photovoltaic plants are low operation and maintenance costs and the fact that thin-film prices are falling. But he notes that thin-film solar’s low efficiency and inability to store the electricity generated — solar thermal plants can store heat in water or molten salt to create steam when the sun sets — puts such power plants at a disadvantage.

And the large tracts of land needed for such solar farm could create conflicts, particularly when threatened or endangered animals and plants are present. “Environmental groups will go crazy,” Tisdale says.

OptiSolar has kept a low profile and has said little about its technology or how efficent it is, other than that it uses just 1% of the silicon needed in conventional solar cells. Many thin-film solar cells have efficiencies of five to six percent though Global Solar Energy CEO Mike Gering recently told Green Wombat that his company has achieved 10 percent efficiency in production runs.

Founded by veterans of the carbon-intensive Canadian oil sands industry, OptiSolar has a factory in Hayward and just signed a deal to build another manufacturing facility in Sacramento.

The company’s Topaz solar farm would be constructed on nine-and-a-half square miles of ranch land in San Luis Obispo County near the site of the 177-megawatt Carizzo Plains solar thermal power plant planned by Silicon Valley startup Ausra. Optisolar spokesman Jeff Lettes told Green Wombat that the company has taken options to buy the 6,080 acres of land from farming families if the county approves the project.

Who would buy Topaz’s electricity remains to be seen. The plant would be in PG&E’s (PCG) territory and Rettger acknowledged that the company has been in talks with big California utilities such as Southern California Edison (EIX) and San Diego Gas & Electric (SRE). Lettes says the company is currently negotiating a power purchase agreement for Topaz but could not comment further.

OptiSolar says its solar farm would generate electricity for about 190,000 homes. Unlike other PV power plants, OptiSolar will not place its panels on trackers that follow the sun throughout the day. That will lower the cost of the plant but also reduce its efficiency. If approved by the county, construction would begin in 2010. Unlike solar thermal plants, photovoltaic power stations do not need to be licensed by the California Energy Commission, a process that can take a year or two to complete.

Still, OptiSolar will face challenges. Some residents have objected to the size and environmental impact of Ausra’s project and the prospect of another large-scale solar facility in their backyard will raise new concerns. The OptiSolar site is also habitat for the protected California kit fox.