In the green stimulus sweepstakes, big potential winners are companies like Silicon Valley startup OptiSolar.

The solar-cell maker came out of nowhere last year to score a deal with utility PG&E to build the world’s largest photovolaic power plant, a 550-megawatt monster that would cover some 9 1/2 square miles on California’s central coast. OptiSolar subsequently began construction of a factory in Sacramento to produce the thousands of thin-film solar panels needed for the project. Then the economy tanked and as financing dried up, OptiSolar laid off half its workforce – some 300 employees – and halted construction of the Sacramento facility.

With a Colorado solar company executive joining President Barack Obama as he signed the $787 billion stimulus legislation into law Tuesday at a solar-powered museum in Denver, OptiSolar and other renewable energy companies stalled by the financial crisis may see their fortunes revive. The package allows builders of big renewable energy projects to apply for a government cash grant to cover 30% of construction costs in lieu of claiming a 30% investment tax credit. A dearth of investors who finance solar power plants and wind farms in exchange for the tax credits has put in jeopardy green energy projects planned for the desert Southwest and the Great Plains. The cash grant would shave about $300 million off the projected $1 billion price tag for OptiSolar’s Topaz Solar Farm.

The stimulus package also includes $2.3 billion to fund a 30% manufacturing tax credit for equipment used to make components for green energy projects, a provision OptiSolar can tap to help finance its solar cell factories. And the company may be able to take advantage of the legislation’s government loan guarantees for large renewable energy projects.

“It will lower the cost of the factory we’re building in Sacramento and make it easier to attract financing,” OptiSolar spokesman Alan Bernheimer told Green Wombat, noting the company’s priority is to complete the facility and begin production of solar panels. “The factory is more than shovel ready – our shovels are hanging on the wall where we put them when we had stop work in November.” (OptiSolar currently manufactures solar modules at its Hayward, Calif., plant.)

Fred Morse, senior adviser to Spanish solar energy giant Abengoa, says the stimulus package puts back on track a $1 billion, 280-megawatt solar thermal power plant the company will build outside Phoenix to produce electricity for utility Arizona Public Service. “With the stimulus bill we’re very confident we’ll be able to finance the project,” says Morse. He says Abengoa expects to use the government loan guarantees to obtain debt financing to fund construction of the project and then apply for the 30% cash refund. “I think the entire industry is very optimistic that these two aspects of the stimulus package, the grants and the temporary loan guarantees, should allow a lot of projects to be built.”

Mark McLanahan, senior vice president of corporate development for MMA Renewable Ventures, agrees. “I expect the government grants to attract new investors,” says McLanahan, whose San Francisco firm finances and owns commercial and utility-scale solar projects.

There are some strings attached, though.

To qualify for the cash grants, developers need to start shoveling dirt by Dec. 31, 2010. That means only a handful of big solar thermal power plants planned for California, for instance, are likely to make it through a complicated two-year licensing process in time to break ground by the deadline. One of those could be the first phase of BrightSource Energy’s 400-megawatt Ivanpah power plant on the California-Nevada border. But BrightSource’s biggest projects, part of a 1,300 megawatt deal signed with Southern California Edison (EIX) last week, won’t start coming online until 2013 at the earliest.

Another Big Solar project, Stirling Energy Systems’ 750-megawatt solar dish farm for San Diego Gas & Electric (SRE), will be racing to meet the 2010 deadline. The project is in the middle of a long environmental review by the California Energy Commission and the U.S. Bureau of Land Management which currently is scheduled to stretch into 2010.

SolarReserve CEO Terry Murphy says his Santa Monica-based startup has a couple of solar power plant projects in the works that should be able to take advantage of the stimulus provisions. “The likelihood of us being able to close on a financial deal has increased,” Murphy says.

Solar analyst Nathan Bullard of research firm New Energy Finance expects the stimulus package to prompt a push for large photovoltaic power projects. That’s because in California such solar farms – which essentially take rooftop solar panels and mount them in huge arrays on the ground – do not need approval from the California Energy Commission and can be built relatively quickly.

That’s good news for companies like thin-film solar cell maker First Solar (FSLR), which builds smaller scale photovoltaic power plants, and SunPower (SPWRA), which has a long-term contract with PG&E (PCG) for the electricity generated from a planned 250-megawatt PV solar farm to be built near OptiSolar’s project.

“It’s great for PV because you can definitely can get construction done by the end of 2010,” says Bullard. “It’s also good news for smaller and mid-sized developers who couldn’t access tax-equity financing.”

The catch, however, is that renewable energy companies still must raise money from investors in a credit-crunched market to cover construction costs, as the government doesn’t pay out the cash until 60 days after a solar power plant or wind farm goes online. And as McLanahan points out, the cost of raising capital from private equity investors is typically higher and will add to the cost of renewable energy projects. Those costs will only rise if the government is late in paying out refunds.

MMA Renewable finances large commercial arrays and solar power plants and then sells the electricity under long-term contracts to customers who host the solar systems. The loan guarantee provision of the stimulus legislation will help secure financing from investors skittish that some of MMA Renewable’s customers may default on their agreements, according to McLanahan.

Says Murphy: “The fact that we’re getting iron into the ground and getting things moving helps us.”

The wind industry also stands to gain from the stimulus package through a three-year extension of the production tax credit for generating renewable electricity as well as the government cash grants and manufacturing tax credit. Despite a record year for wind farm construction in 2008, projects have come to a standstill in recent months as the financial crisis froze development and forced the European-dominated industry to lay off workers.

“I think it’s good down payment on what needs to happen,” says Doug Pertz, CEO of Clipper Windpower, one of two U.S. wind turbine makers. “A lot more needs to be done but I think this will start to bring a lot of people back into the marketplace.”

Read Full Post »

Most people think of National Semiconductor as a chip company. But the Silicon Valley mainstay has been moving into the solar business and on Thursday it scooped up Act Solar, a startup that makes equipment designed to maximize power production from photovoltaic panels.

Most people think of National Semiconductor as a chip company. But the Silicon Valley mainstay has been moving into the solar business and on Thursday it scooped up Act Solar, a startup that makes equipment designed to maximize power production from photovoltaic panels.

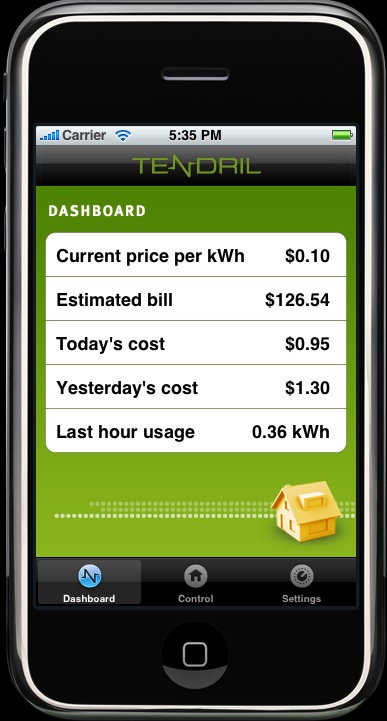

Here’s an iPhone app that really could help save the planet while saving stressed consumers’ money: Boulder, Colo.-based startup Tendril this week unveiled a mobile software program that lets people monitor and control their home’s energy use while on the go.

Here’s an iPhone app that really could help save the planet while saving stressed consumers’ money: Boulder, Colo.-based startup Tendril this week unveiled a mobile software program that lets people monitor and control their home’s energy use while on the go.

into each solar cell, those that aren’t shaded can still produce electricity, according to Arman Naghavi, general manager of Freesale’s Analog, Mixed-Signal & Power Division.

into each solar cell, those that aren’t shaded can still produce electricity, according to Arman Naghavi, general manager of Freesale’s Analog, Mixed-Signal & Power Division. Toshiba and Volkswagen on Thursday unveiled a partnership to develop next-generation battery systems for electric cars.

Toshiba and Volkswagen on Thursday unveiled a partnership to develop next-generation battery systems for electric cars.