photo: BrightSource Energy

As the Nevada legislature debates extending tax breaks for large-scale solar power plants, a new report finds that ramping up solar development in the Silver State could produce thousands of good-paying green jobs while generating nearly $11 billion in economic benefits.

The study from San Francisco-based non-profit Vote Solar concludes that 2,000 megawatts’ worth of big solar thermal and photovoltaic farms — needed to meet Nevada’s electricity demand — would result in 5,900 construction jobs a year during the plants’ building phase, 1,200 permanent jobs and half a billion dollars in tax revenues.

“It is likely that such an investment in solar generating facilities could bring solar and related manufacturing to Nevada,” the reports authors wrote. “The economic impact of such manufacturing development is not included in this analysis, but would add significant additional benefits.”

Vote Solar’s job projections are based on an economic model developed by the National Renewable Energy Laboratory to project the impact of solar trough power plants, the most common, if dated, type of Big Solar technology.

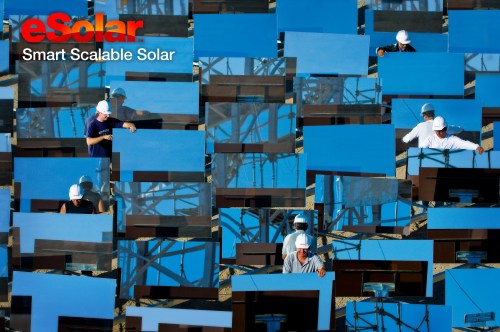

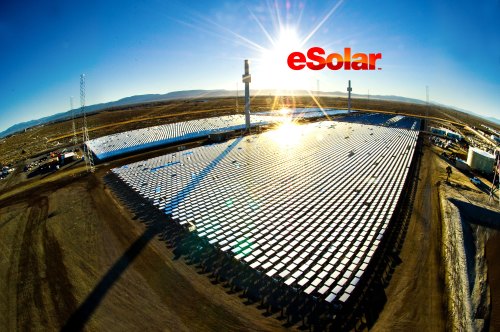

The different solar technologies set to come online in the next couple of years could change that equation. No doubt thousands of jobs will be generated by Big Solar but just how many will depend on the mix of solar thermal and photovoltaic power plants that ultimately come online. New technologies like BrightSource Energy’s “power tower,” Ausra’s compact linear fresnel reflector and Stirling Energy Systems’s solar dish may generate similar numbers of jobs. But then there’s eSolar’s power tower solar farms – which uses fields of mirrors called heliostats to focus the sun on a water-filled boiler, creating steam that drives an electricity-generating turbine. eSolar’s small and prefabricated heliostat arrays cut out much of the skilled labor typically needed on such projects as they can be installed by two workers using a wrench.

Photovoltaic farms essentially take rooftop solar panels and put them on the ground and thus don’t require highly skilled laborers to build turbine power blocks, miles of piping and other infrastructure needed in solar thermal facilities. (They also can be built much more quickly than a solar thermal plant, which is why utilities have been striking deals with companies like First Solar (FSLR) and SunPower (SPWRA) for PV farms.)

A second report released this week — from the Large-Scale Solar Association, an industry group — found that Nevada could gain an edge over Arizona and California in luring solar power plant builders if it extended and sweetened tax incentives. The three states form something of a golden triangle of solar, offering the nation’s most intense sunshine and vast tracts of government-owned desert land that are being opened up for solar development.

The timing of the reports was no accident. The Nevada Legislature held hearings earlier this week on extending tax breaks for Big Solar that expire in June, and Vote Solar’s utility-scale solar policy director, Jim Baak, went to Carson City to lobby legislators, hoping to head off one proposal to tax renewable energy production.

The Large-Scale Solar report, prepared by a Las Vegas economic consulting firm, found that if legislators let the tax breaks sunset, as it were, the developer of a 100-megawatt solar power plant would pay $55.1 million in taxes in Nevada during the first 15 years of the facility’s operation compared to $26.1 million in Arizona and between $36.1 and $37.9 million in California. If the current incentives are kept, tax payments drop to $25.1 million. A bigger tax break would reduce the tax burden to $14.3 million.