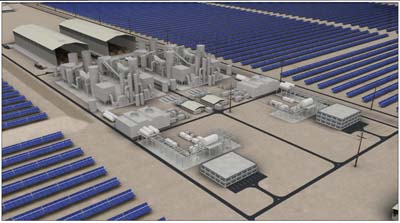

photo: PG&E

I wrote this post for Grist, where it first appeared.

Amid the hullabaloo over government-chartered mortgage giants derailing the green financing program known as Property Assessed Clean Energy, or PACE, the march toward distributed generation of renewable energy — that is, generating electricity from decentralized sources such as rooftop solar panels or backyard wind turbines — continues.

Case in point: The Sacramento Municipal Utility District (SMUD) announced Wednesday that it had awarded contracts to San Francisco’s Recurrent Energy to install 60 megawatts’ worth of solar panels in the region surrounding California’s state capital.

Rather than construct a central solar power station, Recurrent will scatter a dozen five-megawatt installations around two cities in Sacramento County. Each installation will be located near an existing substation, which means that the solar arrays can be plugged directly into the grid without requiring any expensive transmission upgrades.

As I wrote earlier this year in Grist, when SMUD put 100 megawatts of renewable energy contracts out for bid, the allocation sold out within a week. The utility is paying the solar developers a standard premium for their photovoltaic energy — called a feed-in-tariff. But according to calculations done by Vote Solar, a San Francisco non-profit that promotes solar energy, SMUD will pay no more for this clean green solar electricity than it does for fossil-generated power at peak demand times. A 40-percent plunge in solar module costs over the past year has made solar photovoltaic energy increasingly competitive with natural gas, the main fossil fuel used in California to generate electricity.

California’s two big investor-owned utilities, PG&E and Southern California Edison, have launched similar distributed generation programs, which will bring 1,000 megawatts of photovoltaic installations online over the next five years. At peak oputput, that’s the equivalent of a nuclear power plant.

Two weeks ago, PG&E cut the ribbon on the first project to come online as part of its 500-megawatt distributed generation initiative. The two-megawatt Vaca-Dixon Solar Station is built near a utility substation 50 miles north of San Francisco.

It took just nine months to install the fields of solar panels for the Vaca-Dixon station — that’s light speed in a state where the first new big solar thermal power plant in 20 years, BrightSource Energy’s Ivanpah project, has been undergoing licensing for nearly three years.

Solar thermal power plants generate electricity by using mirrors to focus the sun on a liquid-filled boiler. The process creates create steam that drives a conventional turbine which can generate hundreds of megawatts of electricity. Solar thermal projects, by nature, are large centralized facilities, the clean and green versions of a big fossil-fuel power plant.

Photovoltaic farms, on the other hand, generate electricity when sunshine strikes semiconducting materials in a solar cell. If you want to produce more power, you just keep adding solar panels.

While BrightSource hopes to secure a license for its solar thermal project soon, the developer of a hybrid biomass solar trough power plant to be built in California’s Central Valley pulled the plug on the project last month, after spending 18 months and untold millions of dollars in the licensing process before the California Energy Commission.

PG&E has been depending on both those solar thermal projects to supply electricity to help it meet its renewable energy mandates. No wonder then, the utility’s growing enthusiasm for solar panel power. Photovoltaic farms do not have to be approved by California Energy Commission and can be built on already degraded land or close to cities.

And as I reported last month, the developer of another project being built to generate electricity for PG&E, the Alpine SunTower, decided to drop solar thermal technology made by its partner, eSolar, in favor of photovoltaic panels. The official explanation for the switch was that project was being downsized due to transmission constraints and solar panels proved a better fit.

But one has to wonder if economics as much as energy was behind the change. If so, deals like the one SMUD struck could be a recurrent theme.