photo: Todd Woody

Green Wombat’s story in the new issue of Fortune magazine on the solar power plant-fueled boom in demand for wildlife biologists is now online here. The photo above of the blunt-nosed leopard lizard was taken at a state reserve in San Luis Obispo County.

Or you can read the story below.

The hottest tech job in America

Giant solar plants are being built where dozens of protected species live. That’s good news for wildlife biologists.

By Todd Woody, senior editor

(Fortune Magazine) — It looks like a scene from an old episode of The X-Files: As a red-tailed hawk circles overhead and a wild pronghorn sheep grazes in the distance, a dozen people in dark sunglasses move methodically through a vast field of golden barley, eyes fixed to the ground, GPS devices in hand. They’re searching for bodies.

In this case, however, the bodies belong to the endangered blunt-nosed leopard lizard, and the crew moving through the knee-high grain are wildlife biologists hired by Ausra, a Silicon Valley startup that’s building a solar power plant for utility PG&E on this square mile of central California ranchland.

With scores of solar power stations planned for sites in the Southwest, demand for wildlife biologists is hot. They’re needed to look for lizards and other threatened fauna and flora, to draw up habitat-protection plans, and to comply with endangered-species laws to ensure that a desert tortoise or a kit fox won’t be inadvertently squashed by a solar array.

That has engineering giants like URS (URS, Fortune 500) in San Francisco and CH2MHill of Englewood, Colo., scrambling to hire biologists to serve their burgeoning roster of solar clients. “It’s a good time to be a biologist – it’s never been busier in my 15 years in the business,” says Angela Leiba, a senior project manager for URS, which is staffing the $550 million Ausra project. URS has brought onboard 40 biologists since 2007 to keep up with the solar boom. Salaries in the industry, which typically start around $30,000 and run up to about $120,000, have spiked 15% to 20% over the past year.

The work is labor-intensive. “It can take a 30- to 50-person team several weeks to complete just one wildlife survey,” says CH2MHill VP David Stein.

The economics of Big Solar ensure that wildlife biology will be a growth field for years to come. For one thing, there’s the mind-boggling scale of solar power plants. Adjacent to the Ausra project in San Luis Obispo County, for instance, OptiSolar of Hayward, Calif., is building a solar farm for PG&E that will cover 9 1/2 square miles with solar panels. Nearby, SunPower of San Jose will do the same on 3.4 square miles. Every acre must be scoured for signs of “species of special concern” during each phase of each project.

That adds up to a lot of bodies on the ground. URS, for instance, has dispatched 75 biologists to Southern California where Stirling Energy Systems of Phoenix is planting 12,000 solar dishes in the desert. “The biologists are critical to move these projects forward,” notes Stirling COO Bruce Osborn. For one project Stirling had to pay for two years’ worth of wildlife surveys before satisfying regulators.

Just about every solar site is classified as potential habitat for a host of protected species whose homes could be destroyed by a gargantuan power station. (Developers of California solar power plants, for example, have been ordered to capture and move desert tortoises out of harm’s way.) The only way to determine if a site is crawling with critters is to conduct surveys.

While that means a lot of jobs for wildlife biologists, it’s not all red-tailed hawks and pronghorn sheep for these nature boys and girls. The work can get a bit Groundhog Dayish, say, after spending 1,400 hours plodding through the same barley field in 90-degree heat in search of the same blunt-nosed leopard lizard. No wonder then when URS crew boss Theresa Miller asks for volunteers to reconnoiter a decrepit farmhouse for some protected bats on the Ausra site, hands shoot up like schoolchildren offered the chance to take the attendance to the principal’s office.

PG&E (PCG, Fortune 500) renewable-energy executive Hal La Flash worries that universities aren’t cranking out enough workers of all stripes for the green economy. “It could really slow down some of these big solar projects,” he says. Osborn can vouch for that: Biological work on the Stirling project has ground to a halt at times while the company waits for its consultants to finish up surveys on competitors’ sites.

For the young graduate, veteran biologist Thomas Egan wants to say just three words to you: Mohave ground squirrel. The rare desert dweller is so elusive that the only way to detect it on a solar site is to set traps and bag it. “There’s a limited number of people authorized to do trapping for Mohave ground squirrels,” says Egan, a senior ecologist with AMEC Earth & Environmental. “If you can work with the Mohave ground squirrel, demand is intense.”

Read Full Post »

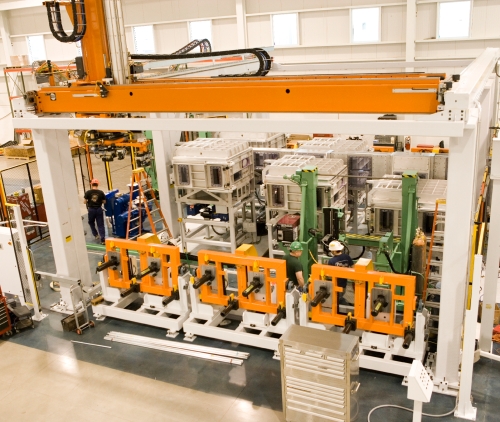

“Our processes really require high productivity, so what makes it competitive here in the Midwest is that we have a great labor force that is eager to work and well-trained already,” ECD chief executive Mark Morelli told Green Wombat on Monday.

“Our processes really require high productivity, so what makes it competitive here in the Midwest is that we have a great labor force that is eager to work and well-trained already,” ECD chief executive Mark Morelli told Green Wombat on Monday.